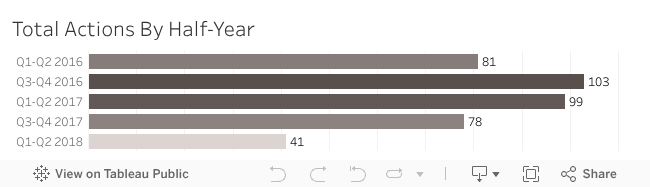

During the first half of 2018, Enforcement Watch tracked 40 publicly announced or publicly filed enforcement actions involving consumer financial services companies. The 18 enforcement actions tracked during Q1 2018 represent a substantial decrease from the 46 actions tracked in Q1 2017. That trend continued in Q2 2018, with Enforcement Watch tracking 22 actions, compared to the 40 such actions during the same quarter last year. This overall decline in enforcement activity was anticipated in last year’s Consumer Finance Year In Review, although the extent to which activity has declined has exceeded our expectations. The majority of Q1 and Q2 actions continues to be settlements (with or without consent orders), while the remainder were court judgments, new actions, and new activity in ongoing enforcement actions.

During the first half of 2018, Enforcement Watch tracked 40 publicly announced or publicly filed enforcement actions involving consumer financial services companies. The 18 enforcement actions tracked during Q1 2018 represent a substantial decrease from the 46 actions tracked in Q1 2017. That trend continued in Q2 2018, with Enforcement Watch tracking 22 actions, compared to the 40 such actions during the same quarter last year. This overall decline in enforcement activity was anticipated in last year’s Consumer Finance Year In Review, although the extent to which activity has declined has exceeded our expectations. The majority of Q1 and Q2 actions continues to be settlements (with or without consent orders), while the remainder were court judgments, new actions, and new activity in ongoing enforcement actions.

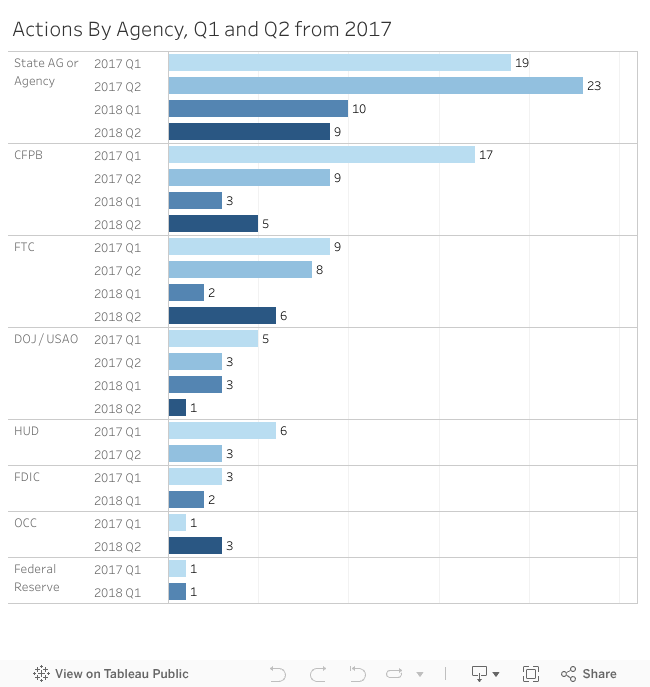

Although there has been a decline in the absolute number of state enforcement actions in the first half of 2018, state enforcement actions still make up a relatively significant percentage of total enforcement actions. In Q1 2018, state attorneys general and other state agencies remained relatively active on the enforcement front compared to federal agencies, accounting for nearly half of all actions tracked (10 of 19) when including joint actions with federal agencies. This number still represents a marked decrease in the absolute number of state enforcement actions from the 19 we tracked in Q1 2017, which itself represented a decline from previous quarters. Q2 2018 continued the trend observed in Q1 2018 with a high percentage of total actions (9 of 22) involving state attorneys general and other state agencies. This, too, represents a decline, in terms of absolute numbers, of state participation in the enforcement arena, as Enforcement Watch tracked 21 such actions in Q2 2017.

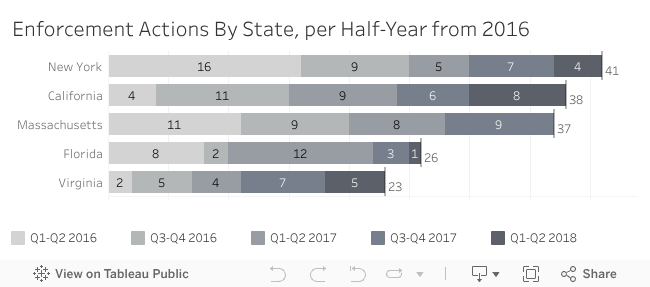

Of the state enforcement actions tracked during the first half of 2018, 5 involved the Virginia attorney general. We first observed this trend last year, as the Virginia attorney general has ramped up enforcement activity under the commonwealth’s consumer protection statutes, particularly against small-dollar lenders. Virginia was among the top three most active states last year (with 8 total actions), and is on pace to surpass that number this year. Meanwhile, the much anticipated increase in enforcement actions brought by large states led by Democratic majorities, such as New York, California, and Massachusetts, has yet to be observed in the tracking data.

The Consumer Financial Protection Bureau (CFPB) and the Department of Justice (DOJ) were the most active federal agencies during Q1 2018 with 3 enforcement actions each. This represents a decrease in activity for both agencies, both from the previous quarter and from the same quarter last year. Q2 2018, however, saw a notable uptick in activity from the CFPB (7 actions), and also the Federal Trade Commission (5 actions). The Q2 increase by the CFPB is not surprising given that Q1 was the first full quarter under Director Mulvaney. No particular sectors of the consumer finance industry were singled-out during the first half of 2018, as actions were initiated and resolved involving auto lending, small-dollar lending, and debt collection. However, debt settlement entities have remained a prime focus of both federal and state enforcement agencies: 7 such actions were tracked during the first half of 2018. The statutes that agencies invoked most often were the Consumer Financial Protection Act (CFPA) and the Fair Debt Collection Practices Act (FDCPA).

Actions By Agency, Q1 and Q2 from 2017-2018:

var divElement = document.getElementById(‘viz1540913712420’); var vizElement = divElement.getElementsByTagName(‘object’)[0]; vizElement.style.width=’650px’;vizElement.style.height=’687px’; var scriptElement = document.createElement(‘script’); scriptElement.src = ‘https://public.tableau.com/javascripts/api/viz_v1.js’; vizElement.parentNode.insertBefore(scriptElement, vizElement);

Federal and state actions in Q1 2018 resulted in recovery of approximately $32.5 million in civil penalties, a slight increase from Q4 2017 ($22.4 million) but still a substantial decrease from Q1 2017 ($667.1 million) and Q1 2016 ($300 million). However, the increase in penalties recovered in Q1 2018 comes amid a decline in the total number of actions, meaning that actions were resolved for higher dollar values. Q2 2018 saw a much higher return for agencies in the form of civil penalties, with agencies recovering $1.052 billion. Nearly all of that amount was from one settlement involving a joint CFPB and Office of the Comptroller of the Currency (OCC) action against a national bank for its auto lending practices including unnecessarily charging borrowers for force-placed insurance, and for failing to follow its mortgage interest rate-lock policies. Even excluding that settlement, however, the remaining $52 million in civil penalties represents an increase in recoveries of civil penalties when compared to the previous two quarters.

Enforcement agencies also collected approximately $64.5 million in damages and equitable relief. This amount is also a fraction of the relief obtained for consumers in Q1 2017 ($508.6 million) and in Q1 2016 ($750 million), but more on par with that provided in Q4 2017 ($70.2 million). Two actions make up nearly the entirety of this amount: a consent order between the Federal Deposit Insurance Corporation (FDIC) and an affiliated bank and lender concerning its debt settlement products, and a settlement reached between state attorneys general and a mortgage lender and servicer concerning its allegedly improper servicing practices. In Q2 2018, enforcement agencies collected more than five times the amount they did in Q1 2018 – over $345 million – but $335 million of that amount was the result of a single settlement between the CFPB and a national bank over its alleged failure to comply with APR reevaluation requirements contained in the Credit Card Accountability Responsibility and Disclosures Act of 2009.

Enforcement Watch will continue to provide real-time reporting on the full range of public federal and state consumer finance enforcement activity, in addition to annual reports synthesizing coverage and offering predictions and insights on what the industry can expect going forward.

Actions By State, per half-year

var divElement = document.getElementById(‘viz1540914007927’); var vizElement = divElement.getElementsByTagName(‘object’)[0]; vizElement.style.width=’650px’;vizElement.style.height=’287px’; var scriptElement = document.createElement(‘script’); scriptElement.src = ‘https://public.tableau.com/javascripts/api/viz_v1.js’; vizElement.parentNode.insertBefore(scriptElement, vizElement);

Total Actions

var divElement = document.getElementById(‘viz1540914099743’); var vizElement = divElement.getElementsByTagName(‘object’)[0]; vizElement.style.width=’650px’;vizElement.style.height=’187px’; var scriptElement = document.createElement(‘script’); scriptElement.src = ‘https://public.tableau.com/javascripts/api/viz_v1.js’; vizElement.parentNode.insertBefore(scriptElement, vizElement);